Building a more affordable Seattle since 1976

This year, Community Roots Housing celebrates 50 years.

What began as a small grassroots program supporting neighbors and offering them free tools to repair their homes has grown — half a century later — into a commitment to confront inequity by creating affordable housing. Community Roots now serves more than 2,400 households across 43 properties.

As part of our anniversary, we are revisiting and sharing our history.

We have divided our story into four eras — each representing a distinct chapter in our growth and our ongoing efforts to keep neighborhoods within reach:

- 1976 – 2007: The first three decades of opening doors

- 2008 – 2019: Housing for a changing Seattle

- 2020 – 2025: Rooting communities through affordable and secure housing

- 2026 – beyond: Foundations for the future

Over the course of the year, we will be sharing different moments and milestones from our 50 year history. To start, we are sharing why the organization was founded.

Our story started in 1976 when the Stevens Neighborhood Improvement Program (SNIP), began taking shape.

Formed in direct response to the state of Capitol Hill in the 1970s, SNIP was grounded in resilience and the fight for fair and equal housing opportunity. At the time, many residents were experiencing displacement driven by redlining, disinvestment, aging housing stock, and increasing inequities. In response, the community organized and took action — laying the foundation that would evolve into what we know today as Community Roots Housing.

1970: Economic and housing crisis

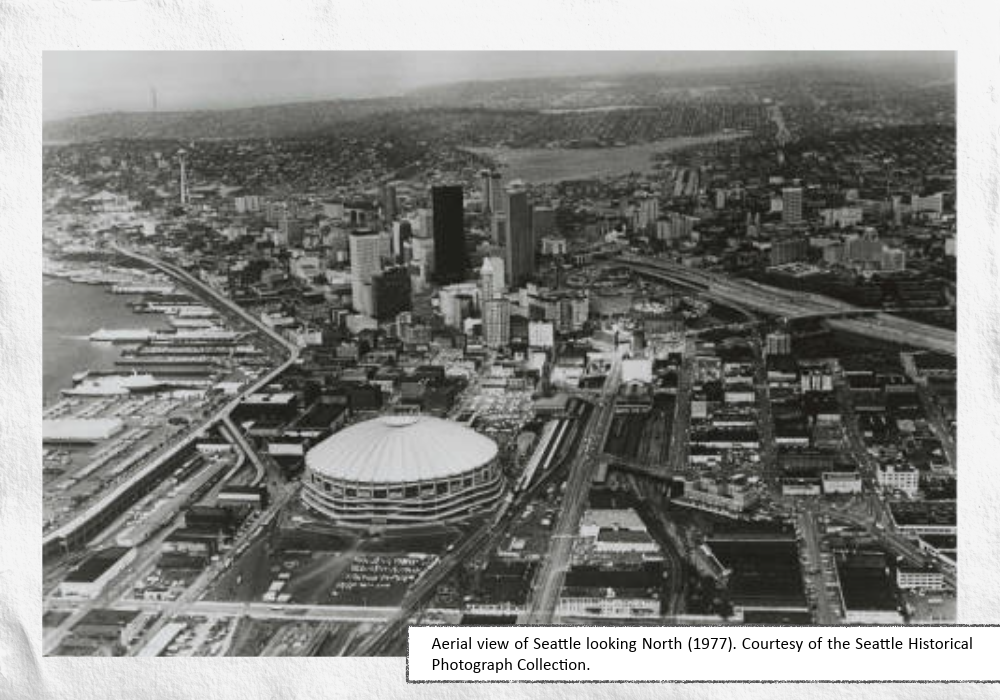

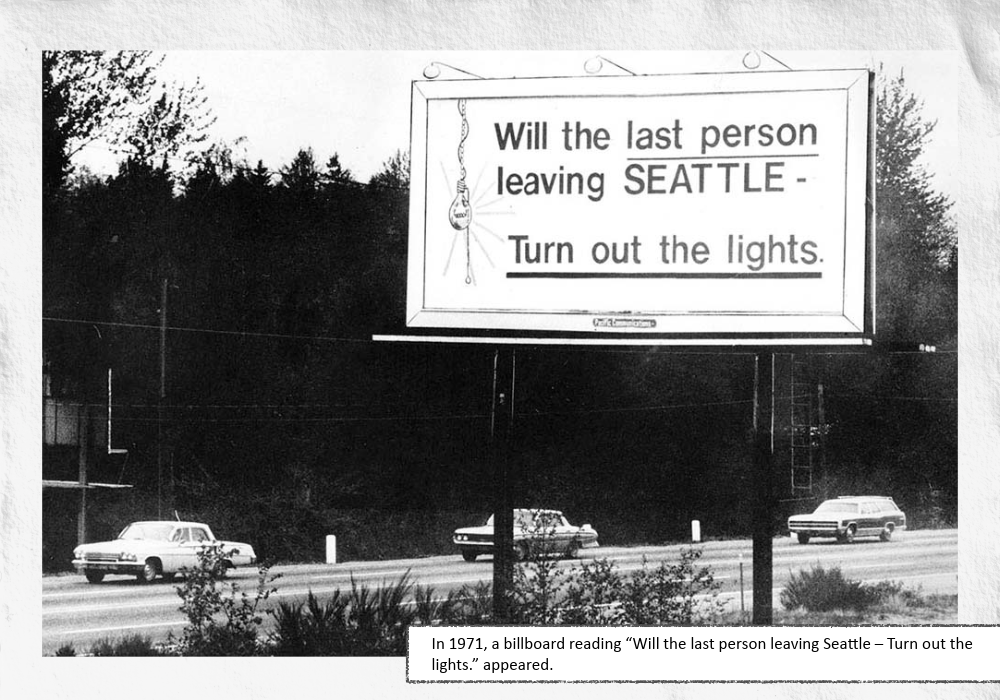

In the 1970s, the region was experiencing deep economic upheaval — parallels of which we can see in 2026.

The Boeing Bust devasted Seattle’s local economy after the Apollo program concluded, and transport programs were cancelled. The aviation industry fell into a recession. Boeing cut 60,000 jobs which resulted in Seattle’s highest national unemployment rates since the Great Depression, peaking at 12%. Workers left Seattle in droves to find sustainability. The city’s population dropped from 565,000 in 1965 to under half a million by 1980.

Housing construction came to a halt as builders lost access to financing. This froze the development of new rentals.

By the late 1970s, Seattle was facing a housing crisis.

Neighborhoods like University District had zero vacancy, while North Seattle, West Seattle, Fremont, Wallingford, and Capitol Hill all fell below 1%. Seattle is still facing a severe housing shortage. In 2025, the average vacancy rate in King County was 5.5%.

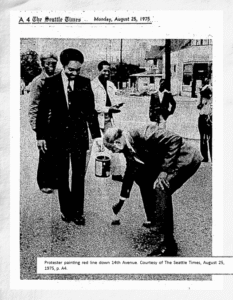

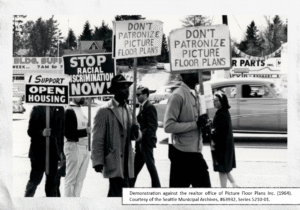

Despite the pressures felt in the 70s, Capitol Hill remained relatively affordable for a time. Its aging subdivided apartments drew young people, artists, and LGBTQ+ residents. As the neighborhood became socially active and politically engaged, many civil rights advocates who lived there pushed back against redlining. Redlining was a discriminatory practice that limited where people could buy or rent homes based on their race or ethnicity, effectively creating whites-only neighborhoods. In the mid 1970s, activists made this fight visible by painting a red line on the streets of the Central District. Many residents were denied home improvement loans from banks and real estate companies, exposing the deep inequities rooted in the neighborhood even amid its thriving culture.

1976: Founding the Stevens Neighborhood Improvement Program

In early 1976, the Capitol Hill Community Council submitted a proposal for a neighborhood rehabilitation program to the Mayor’s Office. Later that year, the Stevens Neighborhood Improvement Program was officially chartered by the City of Seattle as a public development authority.

The program began to improve the lives of neighbors by operating a tool library, providing low interest home repair loans, and offering home sharing for seniors.

SNIP brought accessible resources to the neighborhood through free tool rentals, hands-on workshops, and trainings focused on how to conserve home energy. During a time when residents felt their sense of neighborhood and belonging had vanished, SNIP pushed to foster reconnection.

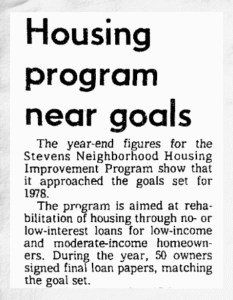

The improvement program also provided low interest home repair loans: around 1977, the interest rate ranged around four to seven percent. This was significantly more affordable than main street banks where mortgage rates ranged from nine to 11 percent. In 1979, SNIP received 95 loan applications from homeowners, 50 of which were approved. Only four years into providing affordable housing solutions, the program began to grow its roots within the community and have an impact.

50 years of affordable housing

Community Roots continues to grow from the same roots that sparked our beginning. From a neighborhood tool library, we have grown into a lasting commitment to inclusive affordable housing. Stay tuned as we continue to share stories and honor the people, movements, and moments that shaped us over 50 years.

![Resized 1936 Redlining National Archives. Records Group 195. Records Of The Federal Home Loan Bank Board [fhlbb], 1933 74](https://communityrootshousing.org/wp-content/uploads/2026/02/Resized_1936_Redlining_National-Archives.-Records-Group-195.-Records-of-the-Federal-Home-Loan-Bank-Board-FHLBB-1933-74-233x300.png)